Stay informed about free updates

Just register to go The Chinese economy myFT Digest — delivered directly to your inbox.

China unveiled an unexpected cut in lending rates days after a top Communist party policy meeting, a sign of the government’s efforts to boost the slumping economy in the world’s second largest economy.

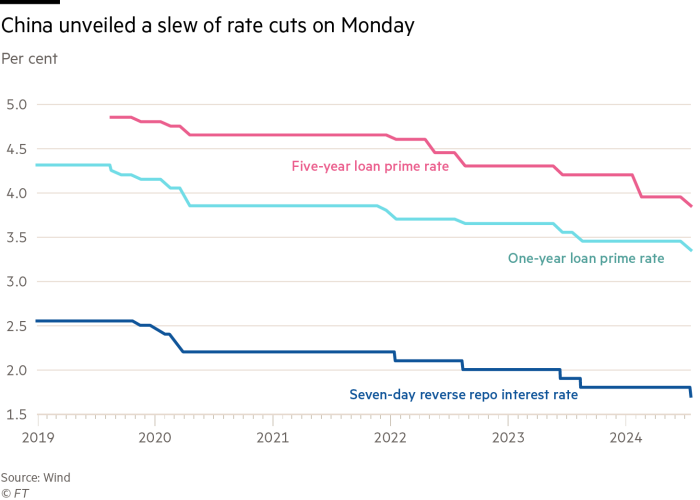

The People’s Bank of China announced on Monday that the one-year lending rate, widely used as a benchmark for corporate loans, will be cut by 0.1 percentage point to 3.35 percent, the first such cut in since August last year.

The five-year rate, which drives mortgage rates, also eased 0.1 percent for the first time since February, to 3.85 percent.

The decline came after China’s central bank cut the so-called reverse repo rate, the seven-day rate used to buy short-term loans, by 0.1 percent to 1.7 percent. The PBoC said the move was aimed at “strengthening countercyclical adjustments to better support the real economy”.

The PBoC on Monday also lowered rates on the so-called standing lending facility, loans given to banks that need short-term capital, by 0.1 percent over total growth.

China has repeatedly cut its borrowing costs in recent years in the face of a long-term recession and weak domestic consumption. Policymakers have been under pressure to act decisively to boost investor and consumer confidence.

Official data last week showed the economy grew by 4.7 percent in the second quarter, missing forecasts, as metrics across the goods sector worsened.

Eswar Prasad, a professor of economics at Cornell University, said: “This modest but very important step shows the government’s willingness, finally, to use macroeconomic stimulus to support the shrinking economy. of the economy.”

The rate cut came after the third plenum of the Chinese Communist Party, a closely watched meeting where the party’s top Central Committee sets its policy direction. At this year’s event, which ended on Thursday, officials expressed concern about the economy and promised more support.

Beijing in recent months has allowed state-owned enterprises to buy unsold homes in order to deal with the property slump. But there are few signs of improvement in the sector, with new home prices falling 4.5 percent last month, the most in nearly a decade.

China’s rate-setting framework has changed dramatically in recent years, with rates such as the LPR linked to a medium-term lending facility set by the PBoC that influences the liquidity of the banking sector. Pan Gongsheng, the central bank’s governor, commented in June on the major role of the repo rate in shaping future policy.

Lynn Song, chief economist for greater China at ING, said that Monday’s reduction “can be seen as the PBoC showing a new seven-day level as the main policy rate” , depending on whether other rates are also reduced in the future. weeks.

Analysts have warned that the impact of such cuts may be modest. Prasad said the LPR reduction “would not work” unless it was “combined with fiscal stimulus and broader policy changes to boost private sector confidence”.

“If the PBoC is serious about monetary stimulus, it should cut rates significantly,” said Julian Evans-Pritchard, head of China economics at Capital Economics. However, efforts to stabilize long-term yields and contain deflation mean that a sharp decline still appears difficult.

China’s 10-year bond yield fell to 2.24 percent on Monday after the cut, while the renminbi eased to a two-week low of 7.28 to the dollar.

Additional reporting by Joe Leahy in Beijing

#China #cutting #interest #rates #bid #support #slowing #economic #growth